The financial sector has once again been hit by a severe cybersecurity breach. Patelco Credit Union suffered a significant ransomware attack that compromised the sensitive personal data of 726,000 customers, illustrating the rising threat of cyberattacks on financial institutions. This incident, orchestrated by the notorious RansomHub ransomware group, highlights the urgent need for robust cybersecurity measures to protect critical data. The breach is part of a broader trend of increasing cybersecurity threats against financial institutions, often leading to severe consequences for both organizations and their customers.

The Nature of the Attack

On May 23, Patelco Credit Union became the latest victim of a ransomware attack. The RansomHub ransomware group, known for their sophisticated methods, launched the attack which culminated on June 29. Utilizing a ransomware-as-a-service (RaaS) playbook, the group managed to infiltrate Patelco’s systems and encrypt a significant amount of data. Ransomware-as-a-service, a model where ransomware is leased out to other criminals, has lowered the entry barriers for cybercrime, leading to more frequent and varied attacks. In the case of Patelco, the cybercriminals were able to access and encrypt crucial customer data, effectively holding the institution to ransom.

The intrusion was sophisticated, leveraging advanced tactics and exploiting potential vulnerabilities within Patelco’s network. The perpetrators of this attack are part of a growing trend where cybercriminals operate with almost business-like efficiency, selling ransomware tools to other criminals. This commodification of cybercrime means that even less technically skilled individuals can execute devastating attacks. The RansomHub group executed their attack by infiltrating the network, encrypting data, and then demanding a ransom in exchange for the decryption keys. Patelco, like many other organizations facing similar attacks, was left to decide between paying the ransom or attempting to mitigate the damages through other means.

Exposed Data

The type of data compromised during the Patelco breach is particularly concerning. The attackers accessed a treasure trove of Personally Identifiable Information (PII), including full names, Social Security Numbers (SSNs), driver’s license numbers, birth dates, and email addresses. Such sensitive information is highly valuable on the dark web and can be used for identity theft and financial fraud. The exposure of PII not only threatens the immediate financial security of affected individuals but also poses long-term risks. Stolen identities can be used in various fraudulent activities that can take years to resolve, causing significant stress and financial hardship for victims. This underscores the gravity of the breach and the importance of protecting such data.

The compromised data represents a dangerous asset in the hands of cybercriminals. With personal details like SSNs and birth dates, malicious actors can open fraudulent accounts, apply for loans, and perform numerous other activities that can have prolonged effects on the victims’ credit and personal lives. Patelco’s customers are now at risk of enduring extended periods of monitoring and rectification efforts to safeguard their identities. The incident highlights the essential need for financial institutions to implement strong encryption and data protection policies to guard against such breaches, reaffirming that PII is a lucrative target for ransomware groups.

Response and Mitigation

In the wake of the attack, Patelco was forced to take swift action to contain the damage. Key online services, including online banking, mobile app functionalities, and various transactional actions, were disabled as the institution worked to secure their systems. This temporary suspension of services created significant inconvenience for customers but was a necessary step to prevent further damage. Patelco took about two weeks to gradually restore these services, ensuring that each system was thoroughly scrutinized and secure before being brought back online. In addition, Patelco offered 24 months of identity theft protection through Experian to the affected customers, a critical mitigation measure to help protect their identities and financial assets moving forward.

The disruption in services underscores the critical balance that must be maintained between swift action and thorough analysis during a cybersecurity crisis. Ensuring a secure and fully operational system before resuming services is paramount, though it may lead to customer dissatisfaction. Upon investigation, Patelco’s cybersecurity team likely undertook a detailed forensic evaluation to understand the breach’s root cause and prevent future incidents. Meanwhile, offering identity theft protection through Experian provided an immediate countermeasure to reassure their customers, demonstrating commitment to mitigating the adverse effects of the attack.

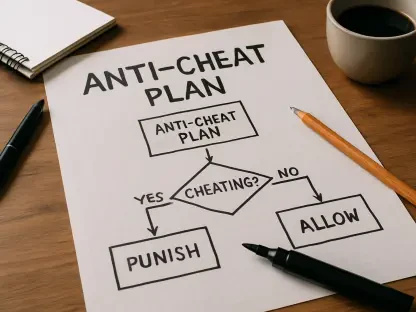

Failed Negotiations and Data Leak

The aftermath of the Patelco attack took a troubling turn when negotiations with the RansomHub group failed. After the credit union refused to meet the ransom demands, RansomHub retaliated by leaking the stolen data on their extortion portal on August 15. This public exposure of sensitive information exacerbated the risk to the affected customers. This incident sheds light on the complex and often contentious interactions between victim organizations and ransomware groups. It also highlights the ethical and strategic dilemmas faced by organizations when deciding whether to pay ransoms, as doing so can embolden and financially support further criminal activities.

The decision to not meet ransom demands was a calculated risk, reflecting a stance that many organizations are increasingly taking in the fight against ransomware. Paying a ransom does not guarantee data recovery and often leads to perpetuating a cycle of crime. Patelco’s choice, while principled, resulted in the public dissemination of their customers’ PII, amplifying the urgency for those affected to take steps to protect themselves against identity theft. Additionally, this scenario underscores the need for law enforcement and cybersecurity frameworks to evolve, offering better support for organizations navigating the treacherous waters of ransomware negotiations.

Broader Implications for the Financial Sector

The Patelco breach is a stark reminder of the vulnerabilities faced by the financial sector in the digital age. Financial institutions, custodians of vast amounts of sensitive personal data, are prime targets for cybercriminals. The incident underscores the pressing need for enhanced cybersecurity measures and protocols to safeguard against such attacks. Ransomware attacks on financial institutions are part of a broader trend impacting various sectors, from healthcare to telecommunications. The commodification of cybercrime through models like RaaS has made it easier for cybercriminals to launch sophisticated attacks, increasing the frequency and severity of these incidents across all industries.

The financial sector must acknowledge that it resides at the forefront of a cyberwar where the stakes are incredibly high. Enhanced cybersecurity protocols, employee training, and awareness about phishing attacks, and investment in cutting-edge security technology are integral to fortifying defenses against an escalating threat landscape. Financial institutions must also collaborate with governmental cybersecurity bodies, sharing intelligence and adopting best practices to collectively uplift security postures. Furthermore, the Patelco incident serves as a poignant reminder for continuous evolution in defensive strategies to shield against ever-more sophisticated cyberattacks.

Necessity for Proactive Measures

The financial sector has been shaken once again by a major cybersecurity incident. Patelco Credit Union fell victim to a substantial ransomware attack that exposed the sensitive personal information of 726,000 customers. This alarming event underscores the growing menace of cyberattacks targeting financial institutions. The attack was carried out by the infamous RansomHub ransomware group, emphasizing the critical necessity for enhanced cybersecurity measures to safeguard crucial data.

This breach is not an isolated case but rather part of a disturbing trend of escalating cybersecurity threats against financial organizations. These attacks often result in dire repercussions for both the institutions involved and their clientele. As cybercriminals become more sophisticated, and their attacks more frequent, the financial sector faces increasing pressure to bolster defenses, implement stringent security protocols, and invest in advanced technologies to mitigate risks. It serves as a powerful reminder to financial entities to prioritize cybersecurity to protect their stakeholders and maintain trust.