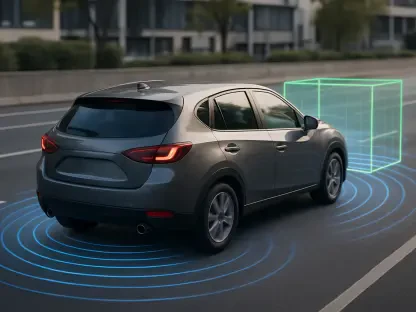

Radiant Capital, a prominent decentralized finance (DeFi) lending protocol, has recently resumed its Ethereum lending markets following a significant security breach that resulted in the loss of $58 million in assets. This breach, which highlighted crucial security weaknesses within the protocol, has propelled Radiant Capital to implement an array of robust security measures to rectify these vulnerabilities and prevent similar incidents in the future. On November 1, the company announced the fortification of its security protocols, including transferring ownership to a timelock contract, which requires a mandatory 72-hour waiting period for any adjustments. This strategic move aims to add a layer of scrutiny and time for verification, potentially mitigating the risks of unauthorized changes and impulsive decisions that could jeopardize the platform’s security.

Additionally, Radiant Capital has introduced an emergency admin role with a multisignature structure; this role can pause and unpause the lending markets as needed. The multisignature approach requires multiple approvals before any critical action can be taken, thus reducing the risk associated with a single point of compromise. This method is increasingly becoming a standard within the DeFi sector as it distributes the responsibility and authority among several trusted individuals, thereby inherently diminishing the risk of individual malpractice or external coercion. The company’s determination to avert further breaches is further reflected in their revamped governance of the decentralized autonomous organization (DAO). By lowering the required signers to seven and instituting a four-out-of-seven signing threshold, Radiant Capital harnesses the multisignature wallet security to curtail the dangers posed by single private key vulnerabilities.

The Breach and Its Repercussions

The breach that Radiant Capital experienced on October 16 was a stark reminder of the cyber threats omnipresent in the DeFi landscape. This attack infiltrated the BNB Chain and Arbitrum, enabling the attacker to seize control over multiple signers’ private keys and smart contracts. A subsequent security assessment revealed that the devices of at least three core developers were compromised by malware. This sophisticated malware subverted the wallets’ front-end interface, enabling malicious transactions to be executed discreetly in the background. Consequently, hackers managed to abscond with over $50 million in assets, demonstrating a well-coordinated and comprehensive attack that exploited blind spots in Radiant Capital’s security framework.

In the wake of this breach, blockchain security firm PeckShield reported that most of the stolen funds had already been moved, rendering recovery efforts largely ineffective. The incident was a significant learning experience for Radiant Capital and the broader DeFi community. It underscored the need for more stringent security protocols and advanced user education to mitigate the risk of blind transaction signing. Security expert Patrick Collins dubbed the event a “$50 million lesson,” highlighting the critical need for enhanced transaction verification processes, particularly through the use of hardware wallets. This perspective aligns with the broader industry objective of disseminating better security practices and educating users about the dangers of blind signing, a sentiment echoed by Ledger CEO Pascal Gauthier.

The Path Forward

Radiant Capital, a notable decentralized finance (DeFi) lending protocol, has recommenced its Ethereum lending markets after a substantial security breach caused the loss of $58 million. This incident exposed significant security flaws within the protocol, prompting Radiant Capital to enforce strong security measures to address these vulnerabilities and prevent future breaches. On November 1, the company announced the strengthening of its security protocols, including transferring ownership to a timelock contract that mandates a 72-hour waiting period for any changes. This move aims to add scrutiny and verification time, potentially reducing the risk of unauthorized changes and rash decisions that could jeopardize the platform’s security.

Moreover, Radiant Capital has implemented an emergency admin role with a multisignature structure capable of pausing and unpausing the lending markets as needed. This model requires multiple approvals for any significant action, lessening the risk associated with a single point of failure. This approach, which spreads responsibility and authority among trusted individuals, is increasingly standard in the DeFi sector. The company’s commitment to preventing further breaches is also evident in their revamped governance of the decentralized autonomous organization (DAO). By lowering the required signers to seven and instituting a four-out-of-seven signing threshold, Radiant Capital leverages multisignature wallet security to mitigate risks associated with individual private key vulnerabilities.