In the wake of a staggering data breach at insurance giant Aflac, we sat down with our in-house security specialist, Rupert Marais, to dissect the incident that exposed the personal and medical information of over 22 million people. With deep expertise in endpoint security and cyber strategy, Rupert offers a critical perspective on the anatomy of this attack. We’ll explore the severe implications of combining personal and health data, the six-month gap between the breach’s discovery and public notification, and the calculated motives of attackers who chose data theft over a ransomware payday. Rupert will also shed light on why the insurance industry has become a prime target and what long-term vigilance looks like for the millions affected.

The breach exposed a mix of personal and medical data for over 22 million individuals. Can you elaborate on why this combination is so dangerous for victims, and walk us through the immediate, critical steps someone should take upon receiving such a notification?

That combination is the absolute worst-case scenario for an individual. It’s a complete identity kit. On one hand, you have the keys to the financial kingdom: names, Social Security numbers, addresses, and driver’s license numbers. On the other, you have incredibly private medical and health insurance information. When criminals have both, they can not only open credit cards in your name but also commit sophisticated medical fraud, like filing false claims with your insurer. The emotional toll of discovering someone has used your identity to receive medical care can be devastating. The very first thing to do is take Aflac up on their offer for 24 months of credit monitoring, but don’t stop there. Immediately place a freeze on your credit with all major bureaus. Then, you must scrutinize every single medical statement and explanation of benefits you receive, looking for services you never had.

Aflac identified the intrusion in June but only began notifying victims around Christmas. Based on your experience, what specific forensic and legal processes typically happen during this multi-month gap, and how does this timeline compare to industry standards for breach investigations?

That six-month window can feel like an eternity for victims, but from inside an investigation, it’s a frantic race against the clock. First, you have to stop the bleeding—containing the attack to ensure the intruders are fully ejected from the network, which Aflac said it did immediately. Then comes the painstaking digital forensics. Experts have to meticulously trace the attackers’ steps, figure out exactly which files were accessed, and determine precisely what data was exfiltrated for all 22.65 million individuals. This isn’t a simple search; it’s like reconstructing a crime scene pixel by pixel. In parallel, legal teams are navigating a complex web of state and federal notification laws. While a six-month delay is on the longer side, for a breach of this scale involving a sophisticated group, it’s not entirely unheard of. The priority is to provide accurate, complete information, not rushed, potentially incorrect notifications that cause more panic.

The report notes that while the attackers were a sophisticated group, they did not deploy ransomware. What does this decision tell us about their primary objectives, and what are the most common ways this massive trove of stolen data might be monetized on the dark web?

The absence of ransomware is a massive tell. It signals that this wasn’t an opportunistic smash-and-grab for a quick ransom payment. This was the work of data brokers, specialists whose entire business model revolves around the theft and sale of high-value information. They knew the data held by an insurance company was a goldmine. Their objective was exfiltration, pure and simple. This massive trove of data is far more valuable on the open market than a one-time payment from Aflac. On the dark web, this information will be packaged and sold in various ways: as complete identity profiles called “fullz,” used to create new lines of credit, or sold to other criminals who specialize in targeted phishing campaigns and medical insurance fraud. This data has a long shelf life and can be monetized for years to come.

Aflac is offering 24 months of credit and identity monitoring. Considering that data like Social Security numbers is permanent, how effective is a two-year solution, and what long-term protective measures should the 22.65 million affected individuals be planning for on their own?

Offering 24 months of monitoring is the industry standard, and it’s a crucial first step, but let’s be blunt: it’s a temporary bandage on a permanent wound. Your Social Security number doesn’t expire in two years. This is a lifelong problem for the 22.65 million people affected. The two-year service is a good safety net to catch immediate fraud attempts, but the real work is on the individual for the long haul. A permanent credit freeze is the most powerful tool in your arsenal. Beyond that, it’s about a permanent shift in mindset. You must now assume that any unsolicited call, text, or email could be a scammer using your stolen data to sound legitimate. This means verifying every request for information and treating your personal data with the highest level of suspicion indefinitely.

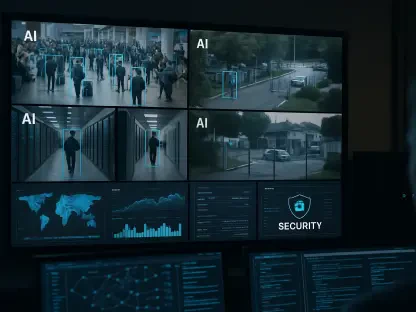

This incident was described as part of a “campaign against the insurance industry.” Can you explain what makes insurance companies such high-value targets for groups like Scattered Spider, and what unique vulnerabilities in their systems are these attackers typically exploiting?

Insurance companies are the ultimate one-stop shop for cybercriminals. Unlike a retailer who might just have credit card numbers, or a social media site with personal preferences, an insurer has everything. They hold a consolidated, comprehensive file on millions of people containing names, addresses, Social Security numbers, financial data, and sensitive health information. That concentration of data is an irresistible target. Attackers like the group suspected here, Scattered Spider, understand this. They often exploit vulnerabilities common in large, established industries—sometimes legacy systems that are difficult to patch, complex networks with many entry points, or, most commonly, the human element through sophisticated phishing attacks against employees. Gaining a single foothold can unlock the entire treasure trove.

What is your forecast for data breach trends in the insurance industry over the next few years?

I see this Aflac breach not as an anomaly but as a sign of what’s to come. The forecast is stormy. Attackers now clearly recognize the immense value of the consolidated data held by insurers, and we’ll see more targeted, persistent campaigns specifically aimed at this sector. I expect a shift away from disruptive ransomware toward stealthy data exfiltration, as the long-term value of the stolen information is much higher. In response, insurance companies will face immense regulatory and public pressure to overhaul their security posture, investing heavily in advanced threat detection and moving away from a simple compliance mindset to one of active, continuous defense. Unfortunately, for the consumer, it means these breach notifications will likely become more, not less, common before the industry fully catches up to the threat.