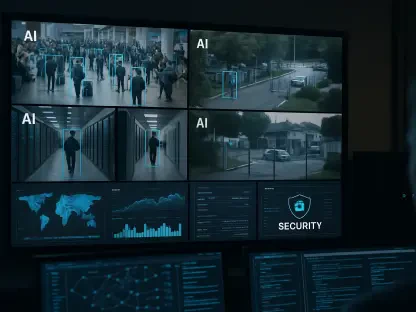

In the digital age of 2025, where online transactions underpin nearly every facet of business, the fight against fraud has reached a critical juncture, with cybercriminals deploying ever-more sophisticated tactics to target industries as varied as e-commerce, financial services, gaming, and travel with relentless precision. The consequences of these attacks are stark—massive financial losses, compromised data, and eroded customer trust threaten the stability of businesses worldwide. Amid this escalating threat landscape, the demand for cutting-edge fraud prevention solutions has never been more urgent. Companies at the forefront of this battle are leveraging advanced technologies like artificial intelligence (AI), machine learning (ML), and behavioral biometrics to outmaneuver fraudsters. Their mission is twofold: to shield organizations from malicious actors while ensuring legitimate users experience minimal disruption. This article explores the leading fraud prevention companies shaping the industry today, delving into their innovative approaches and unique strengths. By highlighting ten standout providers, the discussion aims to equip businesses—whether nimble startups or global enterprises—with the insights needed to select the right partners for securing their operations. From real-time threat detection to tailored industry solutions, these leaders are redefining security standards. The journey ahead will uncover why fraud prevention is paramount and which companies are setting the pace in this high-stakes arena.

The Critical Role of Fraud Prevention Today

In the current digital ecosystem, the proliferation of online services has created fertile ground for fraudsters to exploit vulnerabilities with alarming efficiency. Threats such as identity theft, account takeovers, and payment fraud loom large over businesses of all sizes, striking at the heart of financial stability and customer confidence. The fallout from these incidents often extends beyond immediate monetary damage, triggering regulatory fines and long-term reputational harm that can cripple even the most established organizations. As transactions increasingly move to virtual platforms, the sophistication of cybercriminal tactics continues to evolve, making robust defense mechanisms an absolute necessity. Fraud prevention is no longer a secondary concern but a cornerstone of operational integrity, ensuring that sensitive data remains secure and transactions are protected against unauthorized interference. The urgency to adopt advanced solutions is underscored by the sheer scale of potential losses, which can run into millions for a single breach. This reality places immense pressure on companies to prioritize security measures that can keep pace with emerging risks, safeguarding not just their bottom line but also the trust of their clientele in an environment where digital interactions are the norm.

Beyond the immediate threats, the broader implications of fraud in today’s landscape reveal a complex web of challenges for businesses navigating global markets. Regulatory frameworks are tightening, with stringent requirements for data protection and compliance becoming standard across jurisdictions. Failure to meet these standards can result in severe penalties, adding another layer of risk to an already fraught situation. Meanwhile, the rapid digitization of industries means that even sectors previously less exposed to cyber risks, such as small-scale retail or niche services, are now prime targets for sophisticated attacks. The need for proactive fraud prevention is evident in the way leading companies are stepping up to address these issues, offering tools that not only detect and mitigate threats but also anticipate them through predictive analytics. This shift toward preemptive action is vital in a climate where reaction times can mean the difference between containment and catastrophe. Businesses must recognize that investing in top-tier fraud prevention is not merely a defensive tactic but a strategic imperative to maintain competitiveness and ensure long-term sustainability in a digital-first world.

Core Innovations Driving Fraud Prevention

A deep dive into the strategies of leading fraud prevention companies reveals a striking alignment in their use of groundbreaking technologies to combat cyber threats. Central to their arsenal are AI and ML, which enable the processing of vast datasets to identify suspicious patterns with remarkable speed and accuracy. These tools form the foundation of modern fraud detection, allowing for the rapid analysis of transactions and user behaviors to flag anomalies that might indicate malicious activity. By automating much of the detection process, AI-driven systems reduce human error and ensure that threats are addressed with precision, even in high-volume environments like online marketplaces or banking platforms. This technological backbone is evident across the industry, as providers continuously refine algorithms to adapt to the latest fraud techniques, ensuring that their solutions remain effective against ever-shifting tactics. The reliance on such advanced systems highlights a broader commitment to leveraging innovation as the first line of defense in protecting digital ecosystems from pervasive risks.

Another pivotal innovation shaping the industry is the integration of behavioral biometrics, a method that analyzes unique user interactions—such as typing rhythms or mouse movements—to differentiate between legitimate individuals and potential fraudsters. This approach adds a layer of security that traditional methods like passwords or PINs cannot match, as it operates passively without requiring active input from users. By focusing on how individuals engage with digital platforms, behavioral biometrics offers a subtle yet powerful tool to detect account takeovers or impersonation attempts, often before any financial damage occurs. Many top companies have adopted this technology to enhance their offerings, ensuring that security measures do not come at the expense of user convenience. Real-time monitoring further complements these efforts, providing instantaneous alerts and responses to suspicious activities, a critical feature in sectors where even a brief delay can lead to substantial losses. Together, these innovations reflect a unified industry focus on creating seamless, effective solutions that prioritize both protection and user experience in equal measure.

Key Trends Redefining the Fraud Prevention Landscape

The fraud prevention sector is undergoing a transformative shift, driven by several key trends that are reshaping how companies approach security in the digital realm. One prominent development is the adoption of multi-layered defense strategies that integrate various techniques—identity verification, behavioral analysis, device intelligence, and transaction monitoring—into a comprehensive shield against fraud. This holistic approach recognizes the multifaceted nature of modern cyber threats, where a single point of failure can compromise an entire system. By combining multiple detection methods, leading providers ensure that vulnerabilities are minimized, offering businesses a robust framework to tackle diverse fraud vectors, from payment scams to content abuse. This trend underscores the industry’s understanding that no single solution can address all risks, pushing for integrated platforms that provide end-to-end protection. As cybercriminals grow more inventive, this layered methodology is becoming a standard expectation for organizations seeking to fortify their defenses against an array of sophisticated attacks.

Another significant trend is the rising prominence of behavioral biometrics as a cornerstone of fraud detection, offering a nuanced perspective on user authenticity. Unlike static credentials that can be stolen or replicated, this technology captures dynamic patterns of interaction, making it exceptionally difficult for fraudsters to mimic legitimate behavior. Its passive nature ensures that users face no additional hurdles during their digital engagements, a crucial factor in maintaining satisfaction while upholding security. Additionally, the focus on automation and bot protection is gaining momentum as automated attacks, such as credential stuffing, become more prevalent. Innovative systems designed to distinguish human users from bots are now essential, employing adaptive challenges to thwart non-human actors without disrupting genuine interactions. The reliance on extensive data sources—from credit histories to email metadata—further enhances risk assessment, enabling sharper decision-making in real time. These trends collectively point to an industry that is becoming more anticipatory and data-centric, adapting swiftly to the global scale of fraud challenges and the need for compliance across borders.

Profiling the Pioneers of Fraud Prevention

Among the vanguard of fraud prevention, Socure emerges as a leader in digital identity verification, utilizing AI to generate instantaneous confidence scores that streamline user onboarding for fintechs and online lenders. Its strength lies in achieving high auto-acceptance rates, particularly for hard-to-verify demographics, ensuring that legitimate customers are not turned away due to outdated verification methods. While its focus on identity checks is unparalleled, it places less emphasis on transaction screening, which may require businesses to pair its services with complementary tools for full-spectrum protection. Socure’s expansion into global markets also signals its intent to address cross-border challenges, though its data sources remain predominantly US-centric for now. This specialization makes it an ideal choice for organizations prioritizing secure and efficient customer onboarding, particularly in industries where first impressions and speed are critical to building trust. Its innovative approach to reducing friction while maintaining stringent security standards sets a high bar for competitors, positioning it as a key player in the identity verification niche within the broader fraud prevention landscape.

Sift, on the other hand, excels in delivering real-time fraud detection tailored for digital-first businesses such as e-commerce platforms and marketplaces, leveraging ML and behavioral biometrics to monitor multiple touchpoints. Its ability to address diverse fraud types—from payment scams to account takeovers—through a global network of data insights enhances its detection accuracy, making it a scalable solution for growing companies. The customizable rules engine further allows businesses to adapt Sift’s tools to their specific needs, though pricing transparency can be a concern for smaller entities. Meanwhile, Accertify, supported by American Express, offers enterprise-grade solutions with integrated chargeback management, catering to large retailers and travel companies with complex transaction ecosystems. Its combination of ML and network intelligence ensures robust protection, though its steeper learning curve may deter smaller organizations. Arkose Labs distinguishes itself by targeting automated fraud through risk-based challenges, effectively blocking bots in sectors like gaming and web services without burdening real users, though its systems may need periodic adjustments to maintain optimal performance.

Experian Fraud Prevention harnesses extensive credit bureau data to excel in identity verification and synthetic identity detection, providing real-time decisioning for financial institutions. Its data-rich platform, while powerful, focuses less on behavioral analytics, potentially limiting its appeal for some use cases, and its cost structure may challenge smaller firms. TransUnion TruValidate blends identity proofing with device risk assessment in a user-friendly, cloud-based setup, ideal for businesses needing swift verification, though it lags in behavioral tools. BioCatch leads in behavioral biometrics, using passive user interaction analysis to detect fraud with minimal intrusion, fitting well for banking and e-commerce, but its focus is narrower on payment-specific issues. Emailage offers a unique email-centric risk scoring approach, valuable for merchants reducing chargebacks, though it often serves best alongside broader solutions. Lastly, Seon provides a modular, data-enriched platform with rapid deployment for startups, though it lacks depth in behavioral analysis compared to specialized peers. These profiles highlight the diversity of expertise among industry leaders, offering tailored options for varying business needs.

Navigating the Future of Fraud Prevention

Reflecting on the dynamic fraud prevention landscape of today, it’s clear that the top companies—Socure, Sift, Accertify, Arkose Labs, Experian, TransUnion TruValidate, BioCatch, Emailage, Seon, and ACI Worldwide—set a formidable standard through their innovative contributions. Each brings distinct strengths to the table, addressing a spectrum of threats with AI-driven precision, real-time monitoring, and user-focused designs that balance security with accessibility. Their collective efforts showcase a unified industry resolve to combat fraud through advanced technologies and adaptive strategies, responding to the complexities of digital threats with remarkable agility. The emphasis on reducing false positives and ensuring compliance across global markets demonstrates a mature understanding of the dual demands of protection and user experience. These leaders not only react to existing challenges but also anticipate future risks, laying a strong foundation for businesses to build resilient defenses in an era defined by relentless cybercriminal innovation.

Looking ahead, businesses must take deliberate steps to align with these advancements by assessing their specific vulnerabilities—be it identity fraud, bot attacks, or payment scams—and selecting providers that match their operational priorities. Integrating multi-layered solutions could prove essential, combining the strengths of multiple tools to create a comprehensive shield against diverse threats. Staying informed about emerging trends, such as the growing role of behavioral biometrics and data-driven risk assessment, will also be critical in maintaining a proactive stance. For organizations operating internationally, prioritizing providers with global reach and regulatory expertise will ensure seamless compliance amid varying legal landscapes. As the digital realm continues to evolve, fostering partnerships with these industry pioneers offers a pathway to not just survive but thrive amid ongoing challenges, securing both transactions and trust in an interconnected world.