With financial scams constantly evolving, we turn to our security specialist, Rupert Marais, for his expertise in cybersecurity and fraud prevention. As criminals increasingly pivot from traditional banking fraud to the less-regulated world of gift cards, consumers are facing new and insidious threats. Today, we’ll explore the mechanics behind how these scams are executed both in-store and online, discuss why gift cards have become such a lucrative target, and delve into the ongoing debate between consumer protection and retail convenience. We’ll also look at what retailers can do to safeguard their customers and what the future may hold for this alarming trend.

The story of Emma Johnson’s family losing £120 is unfortunately all too common. Could you walk us through the intricate process criminals use to tamper with gift cards right there on the store shelf, and what tangible signs a shopper should be looking for to avoid that sinking feeling of giving an empty card?

It’s a deviously simple but effective process that preys on the shopper’s trust. A criminal will go to a display, take a handful of cards, and retreat to a quiet spot. They’ll carefully peel back the security sticker that covers the PIN, often using a specific tool to avoid tearing it. They then photograph or write down the card number and the now-exposed PIN. The final step is to meticulously reapply the original sticker or replace it with a convincing duplicate. From that point, they use software to monitor the card’s balance. The moment you activate it at the checkout, their system gets an alert, and they drain the funds online within minutes, long before your loved one ever gets a chance to use it. To protect yourself, you must become a detective. Look for any peeling or bubbling around the edges of the security sticker. Feel the surface; does it feel sticky or tampered with? Also, as Emma Johnson wisely urged, always make sure the card number printed on the card itself matches the one on your activation receipt.

We’re seeing a shocking 25% rise in these cases, with over £18.5 million lost last year alone. Beyond the fact that bank security is improving, what is it about the nature of gift cards that makes them such a golden opportunity for fraudsters, and what makes these crimes a nightmare for authorities to unravel?

The core appeal for criminals is anonymity. A bank transfer creates a clear, traceable digital trail between accounts. Gift cards, however, function like cash in the digital age. Once the money is loaded, it can be spent almost instantly without any personal identification. As Louise Baxter of National Trading Standards pointed out, it’s incredibly difficult to prove you didn’t just willingly give the card to someone. This ambiguity makes prosecution a massive challenge. When you have 9,386 reports of fraud in a single year, you can see the scale of the problem. For law enforcement, it’s like trying to trace a single dollar bill that’s been spent in a crowded market. The funds are quickly converted into goods or even cryptocurrency, and the trail goes cold, leaving authorities with very little to go on.

The threat isn’t just physical; scammers are increasingly using phishing emails and fake online offers. For someone who gets an email promising a free gift card, what are the subtle but critical red flags they should look for, and can you provide a clear, step-by-step process for verifying if an online gift card offer is the real deal?

Digital scams rely on creating a sense of urgency and excitement to make you lower your guard. The biggest red flag is an unsolicited offer that seems too good to be true—because it always is. Look for poor grammar or spelling in the email, and hover your mouse over any links to see the actual web address, which will often be a long, jumbled URL that only vaguely resembles the real company’s name. They are masters of deception. If you receive such an offer, the first step is to never, ever click the link in the email. Instead, open a new browser window and type the official retailer’s web address in yourself. Search their site for the promotion. If you can’t find it on their official page, it doesn’t exist. As Amanda Wolf from Report Fraud advises, always “stop, and think” for that extra 30 seconds. That pause is your best defense against impulse-driven fraud.

The Gift Card and Voucher Association argues that moving cards behind the counter creates “unnecessary friction” and could even cause a 30% drop in sales. From a security standpoint, what’s the counterargument, and what other practical, robust security measures could retailers implement on the sales floor that wouldn’t cripple their business?

The counterargument is that consumer trust is the ultimate currency. While a potential 30% sales drop sounds alarming, the £18.5 million in reported losses represents a catastrophic loss of faith for thousands of customers. Retailers like Tesco say they have “robust” measures, but clearly, they aren’t foolproof. A better middle ground is needed. Instead of moving all cards, retailers could invest in tamper-evident packaging that is destroyed upon opening, making it impossible to reseal without obvious signs of damage. Another powerful solution would be to conceal the card number itself until after purchase, with activation tied to a unique code on the receipt. Furthermore, more rigorous staff training to spot not only tampered cards during stock checks but also to recognize vulnerable customers being coerced into buying large amounts of gift cards would be a huge step forward.

Looking ahead, as criminals continue to “diversify,” what is your forecast for the evolution of gift card scams? Do you see emerging technologies making things easier or harder for fraudsters, and what new tactics should consumers be on high alert for?

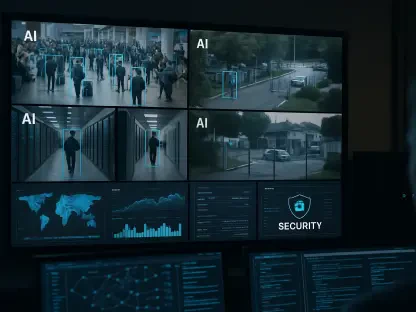

I believe the future of this fraud lies in increasingly sophisticated digital attacks. We’ll see AI-powered phishing campaigns that are grammatically perfect and highly personalized, making them almost indistinguishable from legitimate corporate communications. The scams will also likely shift more toward digital-only gift cards, where fraud can be committed entirely online through compromised accounts. As Louise Baxter said, it’s like a game of “whack-a-mole”—as one vulnerability is patched, criminals find a new one. The most important tactic for consumers to watch for is any scenario where they are asked to pay a fee, a fine, or a bill using gift cards. No genuine organization, from the government to your utility company, will ever request payment in this form. Technology will make the scams slicker, but the fundamental request to use a gift card as a payment method will remain the ultimate, unchangeable red flag.