In the digital age, banks have become prime targets for cybercriminals using increasingly sophisticated tactics to breach their defenses. While existing security protocols have proven effective to an extent, the ever-evolving landscape of cyber threats necessitates adopting more advanced technological solutions. The integration of artificial intelligence (AI) and data analytics in bank security mechanisms is heralded as a transformative approach to staying ahead of cybercriminals. This article explores the pivotal role of AI and data analytics in enhancing bank security, the necessity for collaborative efforts, current security measures, and the crucial role of user education.

The Imperative for Advanced Technologies

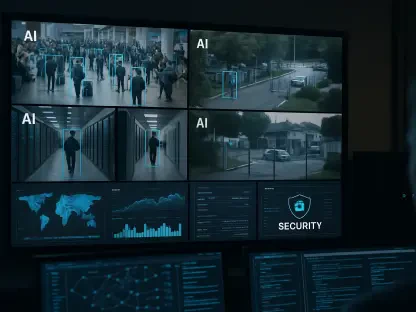

Traditional security measures, albeit robust, have shown limitations against the incessantly evolving tactics employed by online fraudsters. Cybercriminals exploit even the minutest vulnerabilities, continuously altering their strategies to slip through protective protocols. Consequently, banks must adopt more sophisticated security measures capable of dynamically evolving to counter these new threats effectively. AI and data analytics stand out as pivotal technologies in this transformation. By leveraging machine learning algorithms and predictive analytics, banks can anticipate potential threats and respond proactively, thereby fortifying their security infrastructures.AI and data analytics enable the creation of advanced security systems capable of learning and adapting to new threat landscapes. Machine learning models, for instance, can be trained to recognize patterns that signal fraudulent activities. These models process vast amounts of data at speeds unparalleled by human analysts, making them indispensable in identifying patterns and anomalies indicative of cyber threats. Predictive analytics further enhances this capability by analyzing historical data to forecast potential security breaches, allowing banks to bolster their defenses preemptively. Thus, the integration of these technologies not only mitigates immediate risks but also positions banks to stay a step ahead of cybercriminals.

The Power of AI in Fraud Detection

AI’s unparalleled ability to process enormous data sets rapidly and accurately positions it as a powerful tool in fraud detection efforts. Machine learning algorithms can be trained to identify unusual transaction behaviors that human analysts might easily overlook. For instance, AI can detect anomalies in transaction locations, amounts, or frequencies, flagging them for further investigation. This capability is not only crucial for identifying immediate threats but also for uncovering sophisticated fraud schemes that may unfold over extended periods.The continuous learning abilities of AI systems mean they improve over time, becoming more adept at recognizing and responding to new types of fraud. This proactive approach ensures that potential threats are flagged and addressed more swiftly than traditional methods allow. Moreover, by reducing the time taken to detect fraudulent activities, banks can significantly mitigate potential losses. The efficacy of AI in fraud detection is underscored by various real-world implementations, where AI-driven models have successfully reduced fraudulent activities and enhanced the overall security posture of financial institutions.

Data Analytics: Analyzing Trends and Behaviors

Complementing the capabilities of AI, data analytics plays a critical role in analyzing trends and behaviors linked to fraudulent activities. By scrutinizing historical transaction data, banks can identify patterns and trends that may indicate fraudulent behavior. This analysis helps create risk profiles for different types of transactions and customers, facilitating the early detection of anomalies. Data analytics enables banks to sift through billions of transactions in real-time, providing actionable insights that are vital for preventing potential security breaches.The synergy between AI and data analytics thus creates a robust framework for both preemptive and reactive security measures. While AI is adept at identifying and learning from present threats, data analytics offers a broader view by contextualizing these threats within historical trends. This dual approach ensures a comprehensive defense mechanism that is as adaptive as it is proactive, offering a significant edge in the ongoing battle against cybercrime. As banks increasingly integrate these technologies into their security architectures, they are better equipped to handle the complex and dynamic nature of cyber threats.

Collaboration: A United Front Against Cybercrime

While individual efforts by banks to enhance security are commendable, they are often insufficient to tackle the multifaceted nature of online fraud comprehensively. A collaborative approach involving various stakeholders, including telecommunications companies (telcos), social media platforms, and government agencies, is essential to create a robust defense infrastructure. Telcos, for instance, can play a pivotal role by enforcing stricter policies regarding phone number registrations and holding individuals accountable for numbers linked to fraudulent activities. Moreover, social media platforms can aid by monitoring and reporting suspicious activities, thus adding an additional layer of surveillance.Government agencies, with their regulatory and policy-making capacities, provide a structured framework that supports and enhances these collaborative efforts. Policies that mandate sharing of information between banks and other stakeholders can considerably improve the ecosystem’s overall security. For instance, real-time information sharing about new threats can help all parties involved adapt swiftly, thereby minimizing the impact of potential breaches. Ecosystem partnerships thus become instrumental in establishing a united front against cybercrime, fostering an environment where information and resources are shared to bolster collective security measures.

Current Security Measures and Their Efficacy

In response to the alarming frequency of online bank fraud, regulatory bodies such as Bank Negara Malaysia have introduced several measures aimed at enhancing security. Key measures include transitioning from SMS one-time passwords to more secure authentication methods, implementing transaction cooling-off periods, requiring a single designated device for authorization, removing hyperlinks from SMS and email communications, and establishing 24-hour cyber fraud security hotlines. These measures provide a strong foundation for building more advanced, AI-driven security solutions.Banks have actively embraced and implemented these guidelines, with significant results. For instance, Malayan Banking Bhd (Maybank) and CIMB Bank Bhd have reported substantial reductions in unauthorized activities following the adoption of these security protocols. The introduction of features such as the “kill switch” or account lock mechanism and mandatory SecureTAC measures has further bolstered security. These steps, while already impactful, lay the groundwork for integrating more advanced AI-driven solutions, which promise to enhance security measures further.

User Education: Empowering the Frontline

Even the most advanced security measures can falter if users are not aware of the potential risks and do not manage their accounts responsibly. Direct Lending founder Yik Seong Hui emphasizes the importance of user education in preventing online fraud. Banks are increasingly focusing on educating their customers through various channels, ensuring individuals understand the security protocols in place and how to protect their personal information. User vigilance plays a crucial role in detecting phishing attempts and other scams, and an informed user base significantly enhances the overall security posture of a bank.Education initiatives include workshops, informational campaigns, and real-time assistance to make users comfortable with the digital tools and security measures at their disposal. By fostering a culture of awareness and vigilance among users, banks can create a more secure environment that complements their technological defenses. The symbiotic relationship between user education and advanced security protocols forms a comprehensive defense against cyber threats, highlighting the importance of empowering users as the frontline in the fight against online fraud.

Real-World Impact: Case Studies

Recent implementations of AI and data analytics in banking have yielded notable successes, providing compelling evidence of these technologies’ efficacy in enhancing security. For instance, CIMB reported an 88% reduction in unauthorized ID registrations following the adoption of AI-driven security measures. Such results underscore the tangible benefits of integrating AI and data analytics into bank security frameworks, showcasing their effectiveness in real-world scenarios.Other banks have also adopted innovative solutions like the “kill switch” feature, which allows users to immediately lock their accounts in case of suspicious activity, preventing further unauthorized transactions. These case studies highlight not only the potential of advanced technologies in bolstering security but also the necessity for their widespread adoption across the banking sector. By analyzing these real-world examples, banks can learn valuable lessons and continuously improve their security measures to stay ahead of evolving cyber threats.

Future Prospects and Continuous Improvement

In today’s digital era, banks are prime targets for increasingly sophisticated cybercriminals. Although current security protocols are somewhat effective, the constantly evolving nature of cyber threats requires banks to adopt more advanced technological solutions. The integration of artificial intelligence (AI) and data analytics in banking security is seen as a transformative strategy to stay one step ahead of cybercriminals. AI and data analytics can significantly enhance the ability to detect, prevent, and respond to cyber threats. By analyzing vast amounts of data quickly, these technologies can identify unusual patterns and recognize potential threats before they escalate.Additionally, it’s crucial for banks to foster collaborative efforts with cybersecurity experts and regulatory bodies to enhance their defense mechanisms. Current security measures, though robust, need constant updating to address new vulnerabilities. Equally important is the role of user education; customers must be well-informed about security best practices to safeguard their personal information.In conclusion, while the existing protocols offer some protection, the complex and dynamic landscape of cyber threats makes it imperative for banks to leverage AI and data analytics, collaborate broadly, and prioritize user education to ensure comprehensive security. These combined efforts will fortify the banking sector against relentless cybercriminal activities.