Unveiling the Mobile Banking Threat Landscape

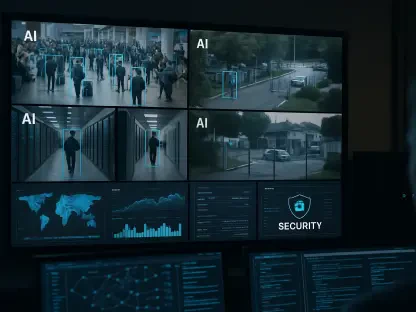

In today’s digital economy, where mobile banking transactions are skyrocketing, a staggering statistic emerges: millions of Android users worldwide are at risk from a sophisticated wave of malware exploiting near-field communication (NFC) technology, call hijacking, and root exploits. This alarming trend, targeting financial data with unprecedented precision, underscores a critical challenge for the banking sector and cybersecurity markets. As contactless payments become the norm, cybercriminals are leveraging cutting-edge methods to siphon funds and intercept sensitive communications, creating a pressing need for robust defenses. This market analysis delves into the current state of Android malware threats, examines key trends shaping the financial security landscape, and projects future risks and opportunities for stakeholders in this rapidly evolving space.

Deep Dive into Market Trends and Data

NFC Fraud: A Growing Menace in Contactless Payments

The rise of NFC technology has revolutionized payment systems, enabling seamless transactions with a tap of a smartphone. However, this convenience has birthed a lucrative market for cybercriminals, with malware like PhantomCard capitalizing on NFC relay fraud to steal card data wirelessly. Predominantly affecting regions like Brazil, where low-value transactions often skip PIN verification, this threat exploits user trust by mimicking legitimate verification processes. Cybersecurity data reveals a sharp uptick in such attacks, with underground platforms offering malware-as-a-service tools that democratize access to NFC fraud capabilities. Financial institutions now face mounting pressure to secure contactless ecosystems as adoption rates climb, signaling a market demand for advanced detection tools and user authentication protocols.

Call Hijacking and Multi-Vector Attacks: Expanding Threat Horizons

Beyond NFC exploitation, the Android malware market showcases a trend toward multi-vector attacks that amplify financial damage. Strains like SpyBanker, prevalent in India, redirect calls to attacker-controlled numbers, intercepting critical banking communications such as two-factor authentication codes. These threats often pair with additional payloads, including cryptocurrency miners, to maximize revenue for cybercriminals while evading traditional security scans. Market analysis indicates that the complexity of these layered attacks drives a growing need for dynamic threat intelligence solutions. As mobile banking apps become central to daily transactions, the cybersecurity sector must prioritize integrated defenses that address both technical vulnerabilities and social engineering tactics.

Regional Disparities and Global Market Implications

Geographic variations play a significant role in shaping the Android malware market, with distinct patterns emerging across different regions. In the Philippines, the surge in contactless payment adoption has turned the region into a testing ground for NFC fraud, exposing systemic gaps in mobile security frameworks. Meanwhile, global vulnerabilities, such as poorly secured rooting tools like KernelSU, enable privilege escalation on devices worldwide, creating a universal challenge for Android ecosystems. The globalization of malware-as-a-service platforms further complicates the landscape, as regional threats quickly scale into international concerns. This trend underscores a market opportunity for cross-border collaboration in cybersecurity, pushing for standardized protocols and shared intelligence to combat these pervasive risks.

Projections for the Mobile Banking Security Market

Emerging Risks in Contactless Payment Ecosystems

Looking ahead, the mobile banking security market is poised for significant shifts driven by the continued expansion of contactless payments. Projections suggest that NFC-based attacks will intensify as transaction limits for PIN-less payments rise, creating more opportunities for fraudsters to exploit unsuspecting users. Analysts anticipate that cybercriminals will refine obfuscation techniques, making malware detection increasingly difficult for static security tools. This evolving threat landscape signals a robust growth trajectory for adaptive security solutions, with demand expected to surge for real-time monitoring systems and behavioral analytics that can identify anomalies in transaction patterns.

Technological and Regulatory Shifts Shaping Defenses

Technological advancements and regulatory changes are set to redefine the Android malware defense market over the coming years. Innovations in malware payload delivery, such as dynamic droppers, are likely to challenge existing antivirus frameworks, necessitating investment in machine learning-driven detection tools. Simultaneously, stricter app store policies and mandatory multi-factor authentication could either curb threats or push attackers to explore alternative vectors, such as wearable devices or IoT ecosystems. Market forecasts from 2025 to 2027 highlight a potential doubling in cybersecurity budgets for mobile platforms, as financial institutions and tech companies scramble to stay ahead of adaptive cybercrime tactics. This period will likely see a race between innovation in defense mechanisms and the ingenuity of malicious actors.

Future Frontiers: Beyond Mobile Devices

As mobile security tightens, projections indicate that cybercriminals may pivot toward adjacent technologies, creating new market challenges. Wearable devices, smart home systems, and other interconnected IoT products could become the next targets for banking fraud, leveraging their integration with mobile payment apps. This shift would expand the attack surface, requiring cybersecurity providers to develop holistic solutions that secure entire digital ecosystems rather than isolated devices. Market stakeholders must prepare for this convergence by investing in cross-platform security architectures, ensuring that emerging technologies do not become the weak links in financial data protection. The next few years will test the industry’s ability to anticipate and neutralize these frontier threats.

Reflecting on Insights and Strategic Pathways

Looking back, this analysis illuminated the multifaceted nature of Android malware threats targeting the banking sector, from NFC relay fraud to call hijacking and root exploits. It revealed a market grappling with the dual forces of technological innovation and cybercriminal adaptability, where regional disparities and global platforms fueled a complex risk environment. The projections painted a future of intensified challenges but also highlighted opportunities for growth in adaptive security solutions. Moving forward, financial institutions need to prioritize real-time transaction monitoring and consumer education on phishing risks. Cybersecurity firms must innovate relentlessly, focusing on machine learning and cross-platform defenses to tackle emerging attack vectors. Ultimately, collaboration across borders and sectors stands as the cornerstone for building a resilient mobile banking ecosystem, ensuring that convenience never comes at the cost of security.